If you’re saving in a tax-advantaged retirement account, you generally have one of two flavors to choose from.

The choice lies in when and how you are taxed. “Traditional” versions of 401(k)s and individual retirement accounts are funded with pre-tax dollars, meaning you get a tax break in the year you make contributions. Roth accounts work the other way around: You pay taxes up front, but you can withdraw your money tax-free, provided you meet certain rules, in retirement.

The argument over what type of account to use usually revolves around how much money you make. Low-earning early-career workers are better off in Roths, the thinking goes, because they’d save money by paying taxes when they’re in a low bracket, rather than waiting until they bring in more in retirement. Meanwhile, high earners generally gravitate toward traditional accounts and their upfront tax relief.

However, some money professionals don’t think you should bother with that particular calculation.

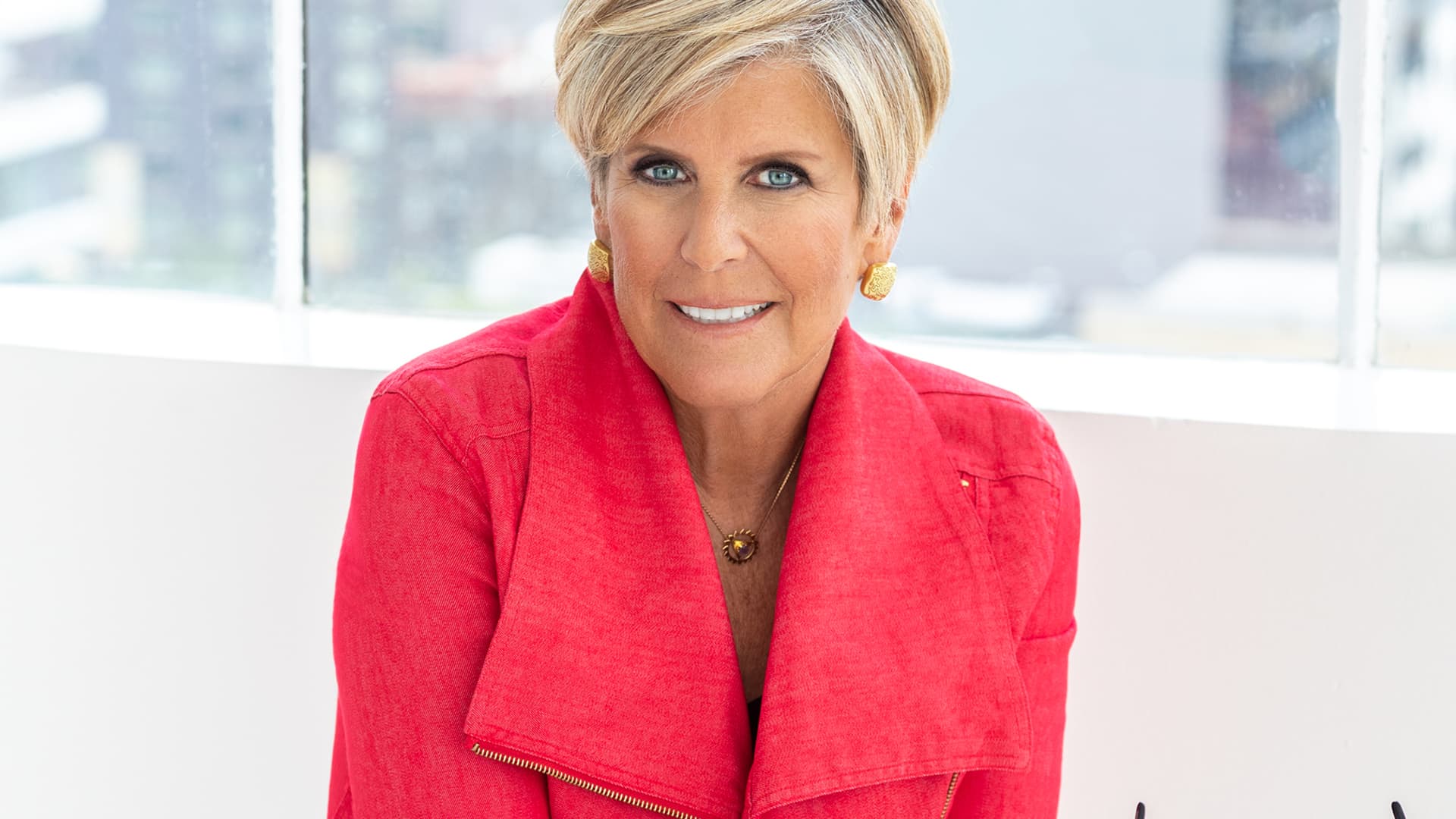

“I don’t care what tax bracket you’re in,” says Suze Orman, a financial expert and host of the Women and Money (and Anyone Smart Enough to Listen) podcast. “You’d have to be crazy to do anything other than a Roth retirement account.”